Introduction of New Stock-based Incentive System for Directors of Asahi Kasei

Asahi Kasei Corp.

The Board of Directors of Asahi Kasei Corp. (“the Company”) today decided to present a proposal at the 126th Ordinary General Meeting of Shareholders (“the Shareholders Meeting”) scheduled for June 28, 2017, to revise the system for remuneration of the Company’s Directors (excluding Outside Directors) by introducing a new stock-based incentive system using a trust (“the System”).

1.Purpose of introducing the System

Remuneration for the Company’s Directors currently comprises basic remuneration and performance-linked remuneration reflecting consolidated financial results and individual performance.

By more clearly linking remuneration of Directors (excluding Outside Directors, the same applying hereinafter) and the Company’s shareholder value, the System is designed to enhance the motivation of Directors to contribute to greater business performance and corporate value of the Company over the medium-to-long term. The system would reinforce the common interest between Directors and shareholders, including both the benefits of share price increases and the risk associated with share price decreases.

Remuneration of Directors is currently limited to ¥650 million or less (of which, ¥50 million or less is for Outside Directors), excluding remuneration for duties performed in the capacity of employee in the case of persons serving as both Director and employee, as approved at the 123rd Ordinary General Meeting of Shareholders on June 27, 2014. The System for stock-based remuneration would operate separately from and in addition to the above, for the Company’s Directors who hold office during the 3-year period (“Applicable Period”) from the fiscal year ending March 2018 to the fiscal year ending March 2020.

If introduction of the System is approved at the Shareholders Meeting, a similar stock-based incentive system is planned for Executive Officers of the Company and for Executive Officers of core operating companies of the Asahi Kasei Group who hold a certain rank.

The System was deliberated at the Company’s Remuneration Advisory Committee, consisting of a majority of Outside Directors, which is established to ensure objectivity and transparency in determining Directors’ remuneration, etc.

2.Overview of the System

(1) Overview of the System

The System is a stock-based incentive system, in which a trust established and funded by the Company (“the Trust”) acquires shares of the Company, and the Company grants the shares to eligible Directors in accordance with Share Grant Regulations adopted by the Board of Directors. Such shares are in principle granted to each Director at the time of his/her retirement from office of Director and, if applicable, any other position as officer of the Asahi Kasei Group.

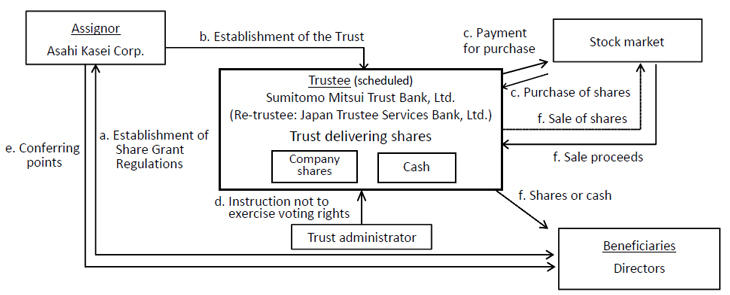

Structure of the System

- a.The Company establishes Share Grant Regulations for Directors.

- b.The Company establishes the Trust (a third-party-benefit trust) for granting shares with Directors as beneficiaries. In doing so, the Company entrusts an amount of money to the trustee equivalent to that for funds to acquire shares (limited to the amount approved at the Shareholders Meeting).

- c.The trustee acquires, in a single tranche, a number of shares of the Company sufficient for the expected future grant of shares (from the stock market, including in after-hours trading.)

- d.The Company appoints a trust administrator (must be a party independent of the Company or any officer of the Company) to be responsible for protecting the interests of the beneficiaries subject to the Share Grant Regulations and for supervising the trustee throughout the trust period. The trust administrator will issue instructions to the trustee not to exercise any voting rights associated with the shares of the Company held in the Trust throughout the trust period, and the trustee will comply with these instructions.

- e.The Company confers points to eligible Directors in accordance with the Share Grant Regulations.

- f.Directors meeting the requirements set forth in the Share Grant Regulations and the trust agreement receive, as beneficiaries of the Trust, a grant of shares of the Company corresponding to the accumulated number of points from the trustee. In certain specific cases set forth in advance in the Share Grant Regulations and the trust agreement, the trustee sells in the stock market a portion of the shares to be granted and grants cash instead.

(2)Establishment of the Trust

The Company establishes the Trust by providing the funds necessary for the Trust to acquire, in a certain period of time in advance, the number of shares of the Company reasonably estimated to be needed for the grants in accordance with (7) below, subject to approval of the introduction of the System at the Shareholders Meeting. The Trust shall, as described in (5) below, acquire shares of the Company by using the funds contributed by the Company.

(3)Trust period

The trust period is approximately three years beginning in August 2017 (planned) and ending in September 2020 (planned); provided, however that the trust period may be extended as described in (4) below.

(4)Maximum amount of funds held in the Trust for acquiring shares of the Company

The Company contributes an amount not exceeding ¥300 million during the 3-year trust period as funds necessary for the Trust to acquire shares of the Company to be granted to eligible Directors under the System. The Trust acquires shares of the Company from the stock market (including in after-hours trading) using funds entrusted by the Company.

Note: The monetary amount to be actually entrusted to the Trust by the Company shall include the estimated necessary expenses such as trust fees and compensation for the trust administrator, etc., in addition to the funds required to acquire shares of the Company.

The trust period may be extended by a resolution of the Company’s Board of Directors (including by effective extension of the trust period by transferring the trust assets of the Trust to another trust established by the Company for an identical purpose, the same applying hereinafter). If the trust period is thus extended, the Company contributes an additional amount not exceeding ¥100 million into the Trust as funds for acquiring shares of the Company necessary for granting to Directors under the System for each year of the extended trust period. At the same time, the Applicable Period is extended in accordance with the extended trust period, and the conferring of points as described in (6) below, as well as the grant of shares of the Company as described in (7) below, shall continue.

However, if the conferring of points is not continued as described above but there are Directors who have not retired from office and who have accumulated points at the end of the trust period, the Company may extend the trust period until such Directors retire from office and the corresponding grant of shares of the Company from the Trust is completed.

(5)Acquisition of shares of the Company by the Trust

Initial acquisition of shares of the Company by the Trust is by purchase from the stock market, in an amount not exceeding the maximum as funds to acquire shares as described in (4) above.

During the trust period, if the number of shares of the Company held in the Trust falls short of the number of shares that corresponds to the number of points to be conferred to Directors during the trust period, due to an increase in the number of Directors, etc., the Company may, without exceeding the maximum amount entrusted as approved at the Shareholders Meeting as described in (4) above, entrust additional money to the Trust in order to enable the trust to acquire additional shares of the Company as required.

(6)Calculation of points to be conferred to Directors

The Company confers to each Director a certain number of points as specified in accordance with their individual rank, etc., on a given date during the trust period, in accordance with the Share Grant Regulations.

However, the total number of points to be conferred to all Directors by the Company during a single fiscal year shall not exceed 100,000.

(7)Grant of shares of the Company to Directors

Directors receive grants of shares of the Company in accordance with their accumulated number of points conferred as described in (6) above.

The number of shares of the Company granted to each Director is equal to the number of points accumulated by each Director (provided that reasonable adjustment may be made if there has been a share split, share consolidation, or other change of circumstances between the time the points are conferred and the time the shares are granted). Nevertheless, a certain proportion of shares of the Company may be sold by the Trust and granted to Directors in the form of cash.

(8)Non-exercise of voting rights

In accordance with instructions from the trust administrator which is independent of the Company or any officer of the Company, voting rights associated with the shares of the Company held in the Trust shall not be exercised at all, in order to ensure neutrality towards the management of the Company with respect to the shares of the Company held in the Trust.

(9)Handling of dividends

Dividends of the shares of the Company held in the Trust shall be received by the Trust to be used to acquire shares of the Company and for trust fees to be paid to the trustee with respect to the Trust.

(10)Handling of assets remaining at the end of the trust period

Of the assets remaining in the Trust at the end of the trust period, all shares of the Company are to be acquired by the Company without consideration and then cancelled by resolution of the Board of Directors, while a certain amount of cash is to be donated to public service entities having no conflict of interest with Directors of the Company, as arranged in advance in accordance with the Share Grant Regulations and the trust agreement.

Overview of the Trust (planned)

- i.Name: Trust for Granting Shares to Directors

- ii.Assignor: Asahi Kasei Corp.

- iii.Trustee: Sumitomo Mitsui Trust Bank, Ltd.

(Re-trustee: Japan Trustee Services Bank, Ltd.) - iv.Beneficiaries: Directors who satisfy beneficiary requirements

- v.Trust administrator: Third party having no conflict of interest with the Company

- vi.Type of trust: Trust of money other than money trust (third-party-benefit trust)

- vii.Date of trust agreement: August 2017

- viii.Date on which money will be entrusted: August 2017

- ix.Trust period: August 2017 to September 2020