Corporate Governance

- Basic Views

- Corporate Governance Framework

- Policy and Procedures to Nominate Candidates for Directors

- Evaluation of the Effectiveness of the Board of Directors

- Officer Remuneration

- Independence Standards for Outside Directors

- Status of Audits by Corporate Auditors, Financial Audits and Internal Audits

- Translation of the Corporate Governance Report

As of June 26, 2019

Basic Views

The Group Vision of the Company is to provide new value to society and solve social issues by enabling "living in health and comfort" and "harmony with the natural environment" under the Group Mission of "contributing to life and living for people around the world." With this as a base, the Company aims to contribute to society, achieve sustainable growth, and enhance corporate value over the medium to long term by promoting innovation and creating synergy through integration of various businesses. The Company continues to pursue optimal corporate governance as a framework to make transparent, fair, timely, and decisive decision-making in accordance with changes in the business environment.

Basic Policies

- 1.Securing the Rights and Equal Treatment of Shareholders

While taking proper measures to secure shareholders' rights, the Company develops a proper environment for exercise of shareholders' rights including paying attention to foreign shareholders and minority shareholders and providing information necessary for the exercise of rights accurately and in a timely manner. - 2.Proper Cooperation with Stakeholders other than Shareholders

The Group Vision of the Company is to provide new value to society and solve social issues by enabling "living in health and comfort" and "harmony with the natural environment" for people around the world, and the Company works to facilitate cooperation with its stakeholders. - 3.Proper Information Disclosure and Securing of Transparency

The Company, in addition to disclosure required by laws and regulations, actively provides information to various stakeholders including financial information such as financial position and operating results, management strategy/issues, and non-financial information concerning risks and governance, etc. - 4.Responsibilities of the Board of Directors

In order to achieve sustainable growth, enhance medium to long term corporate value, and increase earnings ability and capital efficiency, the Board of Directors of the Company presents the overall direction of its management strategy, develops an environment to support risk-taking by the management, and effectively oversees the business management of the Company from an independent and objective standpoint, based on the fiduciary responsibility and accountability to shareholders. - 5.Dialog with Shareholders

The Company develops a system to have a constructive dialog with shareholders/investors and actively promotes such dialog.

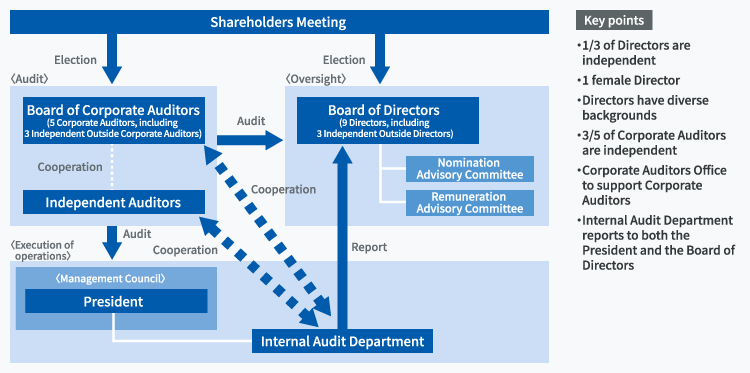

Corporate Governance Framework

Corporate governance configuration

Meetings of Board of Directors, Advisory Committees, and Board of Corporate Auditors (fiscal 2018)

| No. of meetings held | Average attendance | Main subjects of agenda | |

|---|---|---|---|

| Board of Directors | 15 | 98.6% (Directors and Corporate Auditors) |

|

| Nomination Advisory Committee* | 3 | 100% (all members) |

|

| Remuneration Advisory Committee* | 2 | 100% (all members) |

|

| Board of Corporate Auditors | 17 | 97.7% (Corporate Auditors) |

|

Policy and Procedures to Nominate Candidates for Directors

In selecting candidates for Directors, the Company chooses persons with deep insight and excellent skills suitable for Directors. For inside Directors, the Company chooses those with expertise, experience and skills in the required field as candidates. Meanwhile, for Outside Directors, the Company chooses as candidates corporate executives, academic experts, and former civil servants with abundant experience, expecting objective oversight of management based on their deep insight.

To further increase the objectivity and transparency of the nomination of candidates for Directors, the Company has established the Nomination Advisory Committee whose members mainly comprise outside Directors. This committee is involved in the examination of the composition and size of the Board of Directors and the nomination policy for officers and provides advice.

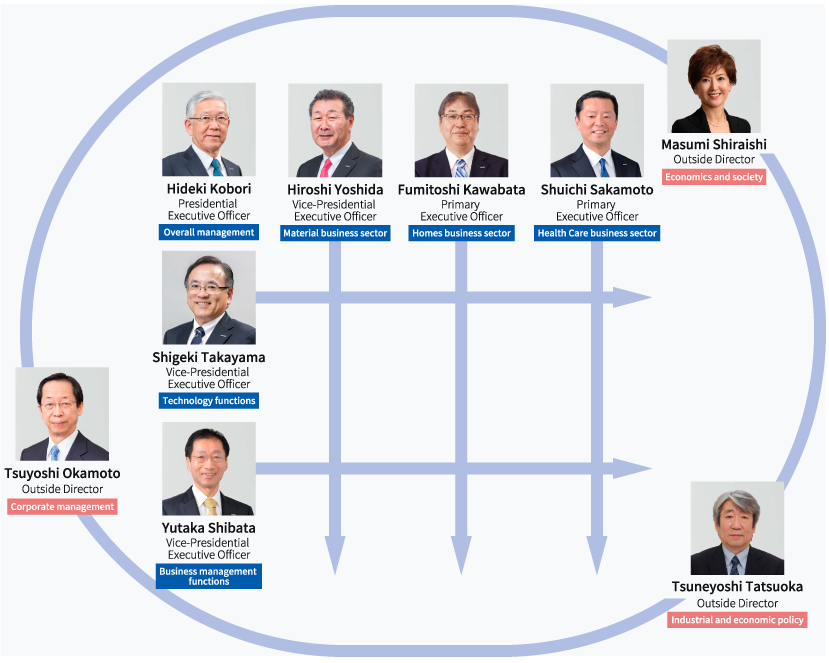

Composition of Board of Directors (beginning in June 2019)

The 6 Directors within the company respectively have responsibility for overall management, technology functions, business management functions, and the Material, Homes, and Health Care business sectors, while the 3 Outside Directors have a diverse range of backgrounds.

Evaluation of the Effectiveness of the Board of Directors

The effectiveness of our Board of Directors is regularly evaluated after each fiscal year, and results of evaluation are disclosed.

Measures implemented in fiscal 2018

The Board of Directors implemented the following measures in fiscal 2018 based on evaluation of the previous fiscal year.

- 1.Enhanced provision of information to Outside Directors and Outside Corporate Auditors

- 2.Sharing information on IR activities and opinions of investors

- 3.Preparations for the new medium-term management initiative

Moving forward

Based on deliberations of the effectiveness of the Board of Directors during fiscal 2018, we will continue and expand the aforementioned efforts in the future. Further, for enriched deliberation by the Board of Directors, we will work to further improve the operation of Board of Directors meetings by reviewing standards for agenda items, improving the format of materials, and securing ample deliberation time. In addition, we will continue to study the further enrichment of the effective operation of the Nomination and Remuneration Advisory Committees, and the optimum size and composition of the Board of Directors, on an ongoing basis.

Officer Remuneration

| Fixed base remuneration | Performance-linked remuneration | Stock-based remuneration |

|---|---|---|

| 50% | 39% | 11% |

- Performance-linked remuneration → commitment to results

- Stock-based remuneration → perspective of shareholders

- The remuneration of Directors is composed of fixed basic remuneration, variable performance-linked remuneration reflecting financial results, and stock-based remuneration. This remuneration is determined following the compensation system approved by the Board of Directors in advance within the maximum amount and maximum number of shares approved at the general meeting of shareholders.

- Basic remuneration is a fixed amount determined based on the rank of each individual Director.

- Performance-linked remuneration is determined based on the Group's consolidated performance and individual performance. Performance is comprehensively evaluated in consideration of the degree of achievement of individually-established objectives, achievements, contributions to financial performance, and the degree of contributions, in addition to management benchmarks including, but not limited to, net sales, operating income, and ROA. These criteria are selected in order to ensure objectivity and clarity of evaluation based on business results and to raise awareness for higher capital efficiency. Variable performance-linked remuneration is calculated by multiplying an index based on performance evaluation by a base amount according to the rank of each Director. Targeted fiscal 2018 financial performance standards for the purpose of variable performance-linked remuneration were consolidated net sales of ¥2,155.0 billion and operating income of ¥190.0 billion, while fiscal 2018 results were consolidated net sales of ¥2,170.4 billion, operating income of ¥209.6 billion, and ROA of 8.1%.

- Stock-based remuneration is granted to executives of the Group upon their retirement based on a number of shares granted according to the rank of each Director, creating a framework wherein current management efforts are reflected in the future stock prices and received as consideration.

- Additionally, remuneration for Outside Directors is comprised solely of fixed basic remuneration based on their role.

- The Company determines the level of remuneration based on research data provided by external specialized agencies, etc.

- The Company's Board of Directors is authorized to determine the Directors' remuneration system and amount of remuneration. In order to ensure the objectivity and transparency of Directors' remuneration, the Company has established a Remuneration Advisory Committee, which consists of a majority of Outside Directors.

- The amount of fixed base remuneration and the number of shares to be granted as stock-based remuneration are determined in advance according to the rank of each Director. The amount of variable performance-linked remuneration is determined in part based on financial results and in part based on individual performance evaluation by the President. Arbitrariness is excluded as individual Directors' remuneration including performance evaluation is subject to prior confirmation by the Remuneration Advisory Committee.

- The Remuneration Advisory Committee consisting of three Outside Directors and two Representative Directors held two meetings in fiscal 2018 with full attendance of all members.

- The performance-linked remuneration system is not applied in the remuneration for Corporate Auditors, in consideration of their role of auditing the execution of duties of Directors in a position independent from Directors, and their remuneration consists of fixed remuneration. Individual remuneration amounts are determined through discussions among Corporate Auditors.

- In addition, the dates of resolutions of shareholders meetings concerning officer remuneration are as follows: June 27, 2014, which set the cash remuneration limit to be paid to Directors at ¥650 million per year, of which annual remuneration for Outside Directors is ¥50 million or less, June 29, 2006, which set. the cash remuneration limit to be paid to Corporate Auditors at ¥150 million per year, and June 28, 2017, which set the stock-based remuneration limit at ¥300 million over three business years.

Independence Standards for Outside Directors

In determining that Outside Directors and Outside Corporate Auditors are independent, the Company ensures that they do not correspond to any of the following and whether they are capable of performing duties from a fair and neutral standpoint.

- 1. Person who currently executes or has executed businesses of the Group (executive Directors, executive officers, employees, etc.) over the last 10 years

- 2. Company or person who executes businesses thereof whose major business partner is the Group (company with more than 2% of its annual consolidated net sales comes from the Group)

- 3. Major business partner of the Group (when payments by this partner to the Group account for more than 2% of the Company's annual consolidated net sales or when the Company borrows money from such partner amounting to more than 2% of the Company's consolidated total assets) or person who executes businesses thereof

- 4. Person who receives money or other financial gain (10 million yen or more in a year) from the Group as an individual other than, excluding remuneration for Director/Corporate Auditor of the Company

- 5. Company which receives donation or aid (10 million yen or more in a year) from the Group or person who executes businesses thereof

- 6. Main shareholder of the Group (person/company who directly or indirectly owns 10% or more of all voting rights of the Company) or person who executes businesses thereof

- 7. Person who executes businesses of a company which elects Directors/Corporate Auditors/employees of the Group as Directors/Corporate Auditors

- 8. Independent Auditor of the Group or any staff thereof

- 9. Person who fell into any of the categories 2 through 8 above over the last three years

- 10. Person who has a close relative (spouse, relative within the second degree of kinship, and those who share living expenses) who falls under any of the categories 1 through 8 above, provided that "person who executes businesses thereof" in 1, 2, 3, 5, 6, and 7 above shall be replaced with "important person who executes businesses thereof (executive Directors and executive officers, etc.)"

Status of Audits by Corporate Auditors, Financial Audits and Internal Audits

- For internal audits of business execution, the company has established an Internal Audit Department, consisting of 16 members as of March 31, 2019, directly supervised by the President. The Internal Audit Department formulates an annual audit plan according to the Company's Basic Regulation for Internal Audits, and conducts an audit of the Group under the approval of the President.

- As for audits by Corporate Auditors, each Corporate Auditor audits the execution of duties of Directors by attending meetings of the Board of Directors and examining the status of execution of operations based on the audit policy stipulated by the Board of Corporate Auditors. To support the function of the Board of Corporate Auditors, the Company has established a Corporate Auditors Office.

- PricewaterhouseCoopers Aarata LLC is contracted as the Independent Auditors to perform financial audits according to the Companies Act and Financial Instruments and Exchange Act.

- The certified public accountants who audited the consolidated financial statements for fiscal 2018 were as follows.

Designated Limited Liability Partnership Engagement Partner: Koichiro Kimura

Designated Limited Liability Partnership Engagement Partner: Taisuke Shiino

Designated Limited Liability Partnership Engagement Partner: Yuichiro Amano - The composition of assistants for performance of the audit in accordance with its audit plan is 19 certified public accountants and 34 other specialist accountants (as of March 31, 2019).

- Mutual cooperation between the Internal Audit Department, Board of Corporate Auditors and accounting auditor is reinforced through periodic liaison meetings of the Internal Audit Department, Board of Corporate Auditors and corporate auditors of operating companies. During these meetings, the effectiveness of the Group's internal control system for legal compliance and risk management is checked. In addition, the Board of Corporate Auditors confirms the audit plan with the accounting auditor and receives reports of the results of audits on the Group at the end of the quarterly consolidated accounting period and at the end of the annual consolidated accounting period.

Adobe Reader is required to view these PDF files.

Click here to download.